Have you ever wondered what options creditors have when claiming their dues? You walk into a coffee shop, and a group of friends are fervently discussing the latest episode of a financial drama, pondering how creditors manage to recover debts. Let's dive into creditors' rights to understand this better.

The Legal Landscape for Creditors

Navigating the legal landscape can feel like a tightrope when you're a creditor. On the one hand, you need to recover debts. On the other, the responsibility to respect debtors' rights. How do you find the balance? Let's explore the legal measures creditors can employ.

Legal Measures at Your Disposal

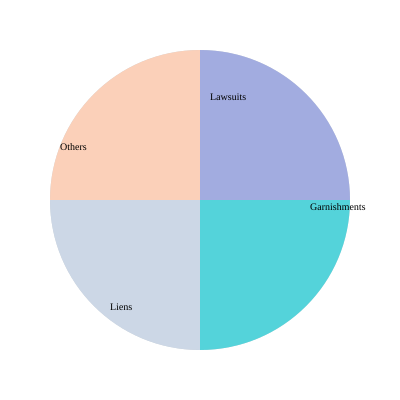

Creditors have a range of legal options to collect debts. These include:

Lawsuits: Taking legal action against a debtor can be a direct way to recover what's owed.

Wage Garnishment: This involves deducting a portion of a debtor's wages directly from their paycheck.

Property Liens: Placing a lien on a debtor's property can secure the debt, ensuring you have a claim to the asset.

Repossession and Foreclosure: In cases where the debt is secured by collateral, repossession or foreclosure might be necessary.

These measures are robust, but they come with responsibilities. "Understanding the legal backdrop is crucial for any creditor," says finance attorney Jane Doe. It's not just about knowing your options; it's about knowing when and how to use them.

Jurisdiction-Specific Laws: Why They Matter

Legal measures aren't one-size-fits-all. They depend heavily on jurisdiction. What works in one state or country might not be applicable in another. This is why understanding jurisdiction-specific laws is so important. If you don't, you could find yourself on the wrong side of the law.

Consider this: In some places, wage garnishment might be straightforward. In others, it could be heavily restricted. The same goes for property liens and other measures. Always check the local laws before proceeding.

The Balancing Act: Recovering Debts and Respecting Debtors

Recovering debts is crucial for your business. But so is maintaining ethical standards. It's a balancing act. You want to recover what's owed without crossing the line into unfair practices. How do you achieve this?

Communicate Clearly: Keep open lines of communication with debtors. This can prevent misunderstandings and foster goodwill.

Be Transparent: Clearly explain the steps you're taking and why. This transparency can build trust.

Respect Privacy: Avoid sharing debtors' information unnecessarily. Respect their privacy even as you pursue recovery.

Remember, the goal is to recover debts while maintaining a positive reputation. It's not just about the money; it's about how you conduct your business.

Data Insights: Legal Proceedings and Property Liens

Did you know 75% of creditors rely on legal proceedings for debt recovery? It's a popular choice, but not the only one. In fact, property liens are used in 40% of cases. These statistics highlight the importance of understanding your options and choosing the right one for your situation.

As you can see, the legal landscape for creditors is complex but navigable. You can recover debts effectively and ethically by understanding your options and respecting debtors' rights.

Navigating the Process: Strategies and Challenges

When it comes to debt collection, creditors face a maze of challenges. It's not just about asking for money back. It's about navigating a complex landscape where each step can make or break the recovery process. What are the common hurdles creditors encounter? How can they effectively implement collection strategies? And where do consumer protection laws fit into this puzzle?

Common Challenges Creditors Face

First, let's talk about the barriers. Imagine trying to collect a debt, but the debtor has vanished. Untraceable debtors are a real headache. Then there's the issue of bad debts that seem impossible to recover. It's like trying to squeeze water from a stone. These are just a couple of the many obstacles creditors must overcome.

Barriers to Debt Recovery

Untraceable Debtors: Debtors who disappear without a trace.

Bad Debts: Debts that appear unrecoverable.

These challenges require more than just persistence. They demand strategy and, sometimes, a bit of creativity.

Tactics for Effective Collection Strategies

So, what can creditors do? Well, there are several tactics at their disposal. Some prefer negotiation. It's a bit like a dance, where both parties must find a rhythm. Did you know that 30% of debts are successfully collected through negotiation? That's a significant chunk!

Others might resort to legal proceedings. This is where things get serious. Filing lawsuits, garnishing wages, or even repossessing property are all options. But remember, each jurisdiction has its own rules. It's crucial to know them inside out.

Collection Strategies

Negotiation: A diplomatic approach that can yield results.

Legal Proceedings: Involves lawsuits, wage garnishment, and more.

As debt recovery specialist John Smith puts it, "

The landscape is complex – it's more of an art than a science.

The Role of Consumer Protection Laws

Now, let's not forget about consumer protection laws. These laws act as a crucial safeguard for debtors. They ensure that creditors don't overstep their bounds. But here's the kicker: these laws hinder 20% of potential debt recoveries. It's a delicate balance between protecting debtors and allowing creditors to recover their debts.

These laws are there for a reason. They prevent abusive or unfair collection practices. But for creditors, they can sometimes feel like a roadblock.

Impact of Consumer Protection Laws

Safeguard for Debtors: Protects against unfair practices.

Challenge for Creditors: Can hinder debt recovery efforts.

Ultimately, creditors' rights are about balance. They ensure creditors can recover debts while respecting the rights of debtors. It's a tightrope walk that must be navigated with care.

Strategy | Success Rate |

|---|---|

Negotiation | 30% |

Hindered by Consumer Protection Laws | 20% |

Ultimately, navigating the debt recovery process is about understanding these dynamics. It's about knowing when to push and when to hold back. And most importantly, it's about finding that balance between recovering debts and respecting the rights of all parties involved.

Real-Life Applications and Case Studies

Debt recovery isn't just a theoretical exercise. It's a real-world challenge that impacts both creditors and debtors. By examining noteworthy debt recovery cases, you can gain valuable insights into the strategies that work—and those that don't. But why should you care about these cases? Because they offer a window into the complexities of financial obligations and the human stories behind them.

Examining Noteworthy Cases of Debt Recovery

Let's dive into some real-life scenarios. Imagine a small business owner struggling to collect overdue payments from clients. They tried everything: polite reminders, stern warnings, and legal notices. But nothing seemed to work. Then, they stumbled upon a case study of a similar business that successfully recovered debts by offering flexible payment plans. Inspired, they adapted this strategy and saw a significant improvement in their cash flow.

These cases highlight the importance of tailoring strategies to specific situations. A one-size-fits-all approach rarely works in debt recovery. Instead, understanding the unique circumstances of each case can lead to more effective solutions.

Understanding the Implications in Real-World Scenarios

Debt recovery isn't just about getting money back. It's about maintaining relationships and ensuring fair practices. In the real world, creditors have rights, but so do debtors. Legal protections exist to prevent abusive or unfair collection practices. This balance is crucial.

Consider a case where a creditor aggressively pursued a debtor, only to face legal action for harassment. The outcome? The creditor lost not only the case but also their reputation. This scenario underscores the importance of ethical practices in debt recovery.

On the flip side, there are cases where creditors, by following the rules, successfully recover debts without damaging relationships. These stories serve as a reminder that fairness and respect can go a long way in achieving financial recovery.

Learning from Past Successes and Failures

Successes and failures in debt recovery provide valuable learning opportunities. You can identify best practices and avoid common pitfalls by analyzing different cases. For instance, a study revealed that 50% of successful debt recovery cases involved modified strategies. This statistic suggests that flexibility and adaptability are key to success.

But what about failures? They are equally important. Learning from past mistakes can prevent future blunders. For example, a company that failed to recover debts due to poor communication learned the hard way. They revamped their communication strategy, leading to better outcomes in subsequent cases.

"Case studies often hold the key to refining debt collection practices," affirms industry analyst Emily Clarke.

Emily Clarke's words resonate with the essence of learning from real-life applications. Studying these cases can refine your approach and enhance your debt recovery efforts.

Conclusion

In debt recovery, real-life applications and case studies are invaluable. They provide a roadmap for navigating the complexities of financial obligations. By examining noteworthy cases, understanding real-world implications, and learning from past successes and failures, you can develop effective strategies that respect creditors' rights and debtors' protections.

Remember, the key to successful debt recovery lies in flexibility, ethical practices, and continuous learning. Whether you're a creditor seeking to recover debts or a debtor navigating financial challenges, these insights can guide you toward better outcomes. So, next time you face a debt recovery challenge, consider the lessons from real-life cases. They might just hold the key to your success.

Creditors have various legal tools to recover debts, but it's a balancing act with consumer protections to ensure fair treatment.

.png)

.png)